In the dynamic world of trading, knowing how to enter and exit the market is just as important as knowing when to do so. That’s where understanding order types comes into play. Whether you’re a retail trader or someone diving deep into order flow trading, your success depends on how well you manage your executions.

Each order type — Market, Limit, and Stop — serves a specific purpose. When used wisely, they can protect your capital, enhance your strategy, and even provide insight into market sentiment via tools like Footprint charts, Order Books, and DOM (Depth of Market).

What is a Market Order?

Definition and Execution Logic

A market order is the simplest type of order: it tells your broker to buy or sell an asset immediately at the best available price.

Example: If the current price of Bitcoin is $30,000 and you place a market buy order, your broker will match it instantly with the lowest available sell price — possibly $30,050 depending on liquidity.

Pros and Cons of Using Market Orders

Pros:

- Instant execution

- Useful in fast-moving markets

- Ideal for breakout entries

Cons:

- No price guarantee

- Risk of slippage in volatile markets

- May execute at a worse price than expected

When Should You Use a Market Order?

Market orders are best used when:

- You need to enter quickly before a major price move

- There’s strong confirmation of a breakout

- You’re in a liquid market where slippage is minimal

What is a Limit Order?

How Limit Orders Work

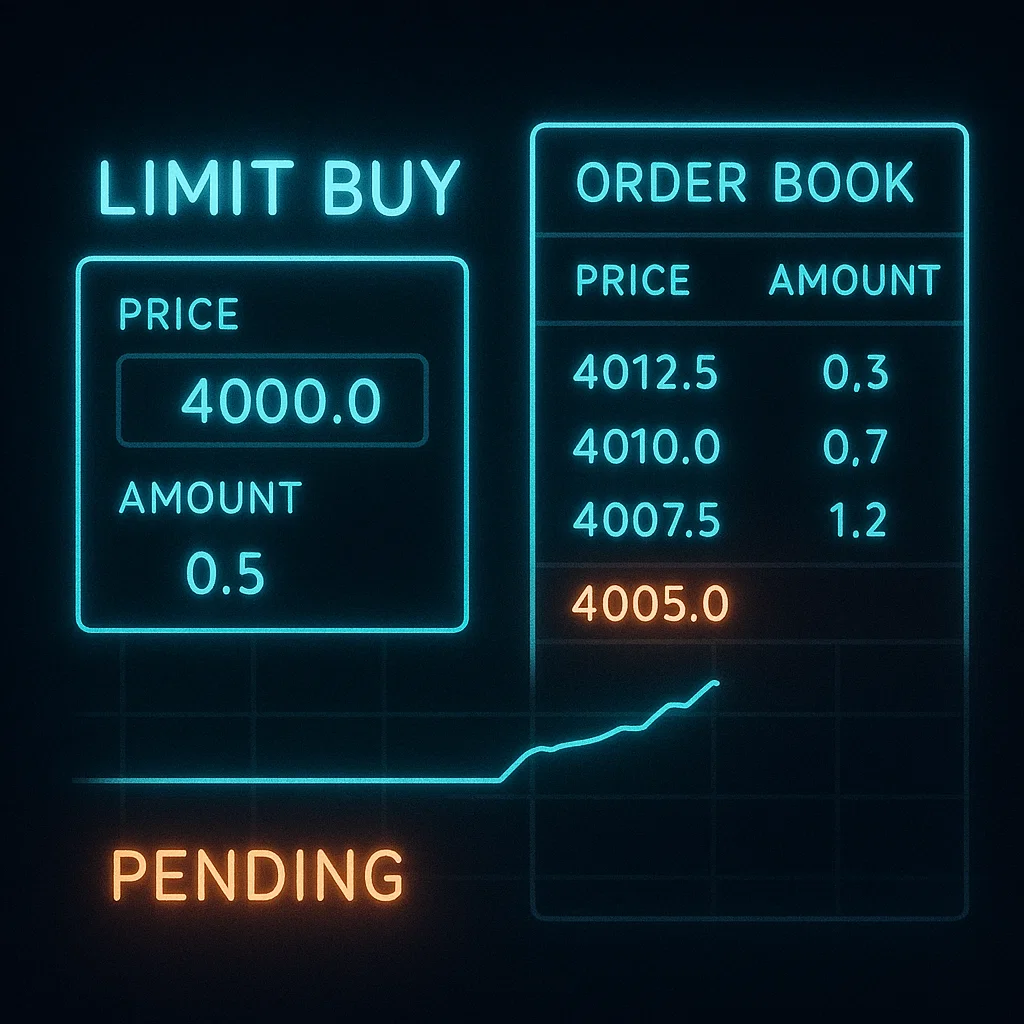

A limit order allows you to set the exact price you’re willing to pay (or accept) for an asset. The order will only execute if the market reaches your specified price.

Example: If a stock is trading at $100 but you want to buy it only at $95, you place a Buy Limit Order at $95. It will sit in the order book until the price drops and your order gets matched.

Use Cases in Support and Resistance Trading

Limit orders are highly effective when:

- Buying at a support zone

- Selling at resistance levels

- Entering during pullbacks or retracements

Benefits and Limitations

Benefits:

- Price control

- No unexpected slippage

- Better suited for range trading

Limitations:

- No guarantee of execution

- Can miss trades if the market doesn’t touch your price

What is a Stop Order?

Stop vs Stop-Limit Orders

A stop order becomes a market order when the price hits a certain level, known as the stop price.

Example: You think a stock will rise if it breaks above $105, so you place a Buy Stop Order at $105. Once the price hits $105, the order turns into a market order and executes at the next available price.

Stop-Limit Order variation adds a maximum price limit to prevent overpaying during fast moves.

Psychological and Strategic Uses

Stop orders are powerful when:

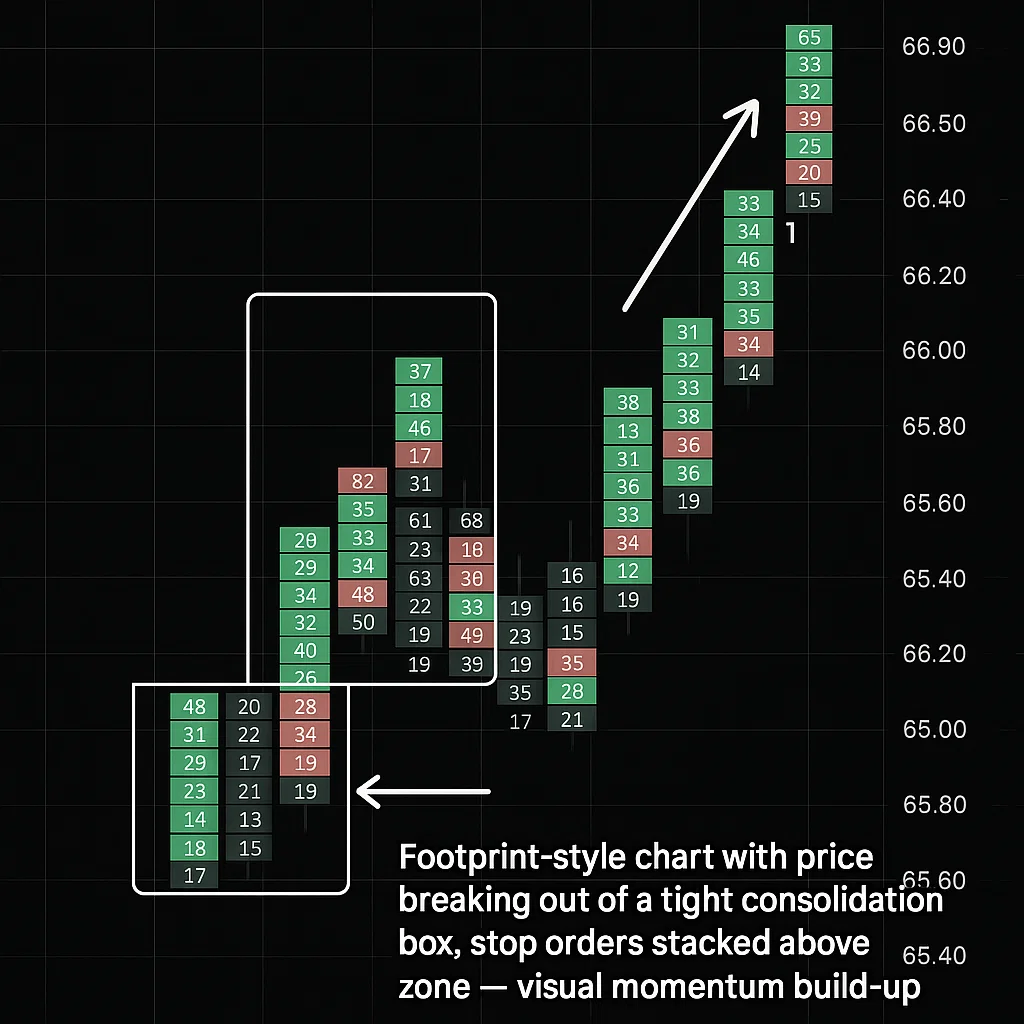

- Trading breakouts or breakdowns

- Avoiding premature entries in consolidation zones

- Automating trend-following strategies

Examples of Stop Orders in Breakout Strategies

- Buy Stop above a consolidation range

- Sell Stop below key support to ride momentum

Visualizing Order Flow: Tools and Concepts

Understanding how orders behave in real time gives traders a massive advantage. This is especially true for those using order flow trading strategies. Order types play a crucial role in how tools like the Footprint chart, DOM (Depth of Market), and Order Book visualize trading activity.

Order Book, Footprint Charts, and DOM Explained

- Order Book: Shows all the current buy (bid) and sell (ask) limit orders. Helps visualize supply and demand.

- Footprint Chart: Displays actual executed trades at each price level, showing volume and whether the buyer or seller was aggressive.

- DOM: Lists the number of contracts or shares waiting to be bought or sold at each price level, helping traders see liquidity pockets.

How Order Types Influence Order Flow Visualizations

- Market Orders hit the existing limit orders and trigger trades — they move the market.

- Limit Orders rest on the book and create market structure — they define support and resistance.

- Stop Orders, once triggered, convert to market orders and appear as a burst of volume on Footprint or DOM.

Understanding the interaction between these types helps order flow traders predict potential market turns or continuations.

Institutional vs Retail Order Behavior

Institutional Engineered Orders vs Retail Simplicity

Institutions don’t just place basic orders — they use complex order routing algorithms to mask their intent. They may:

- Split large orders into smaller ones

- Use iceberg orders to hide size

- Place spoof orders to manipulate perception (though illegal in many markets)

Retail traders, by contrast, often use basic order types without considering their footprint. This predictability can be exploited by larger players unless understood and corrected.

Why Retail Traders Should Understand Order Clusters

Clustering of limit orders around support/resistance levels gives insight into future price reactions. If you notice large blocks of limit orders stacked on the DOM or Order Book, it could indicate a significant level institutions are defending or attacking.

Order Type Selection for Different Market Conditions

Choosing the right order type is context-dependent. Using the wrong order in the wrong market condition can either cost you money or result in missed opportunities.

Trending vs Ranging Markets

- Trending Markets: Stop orders can help you enter with momentum after confirmation. Limit orders might get left behind.

- Ranging Markets: Limit orders are ideal for buying low/selling high within a defined range. Stop orders could trigger prematurely due to false breakouts.

High-Volatility News Events

During major news like interest rate decisions or NFP, market orders often get filled at unfavorable prices due to thin liquidity. Limit orders might never fill. The safest move is to avoid entry until volatility stabilizes or use a small size with wide stop-loss buffers.

Common Mistakes Traders Make with Order Types

Misplacing Limit Orders in Fast Markets

Traders often place limit orders expecting a pullback, only to miss the move entirely. In strong trends, price may never return to your limit level — a classic case of being “right but not in the trade.”

Overusing Market Orders During Slippage

Executing a market order during low liquidity times (like after hours or during news spikes) can cause major slippage, where you’re filled far away from your intended price. Use them sparingly and strategically.

Best Practices for Using Order Types Effectively

Layering Orders for Risk Management

Instead of placing one large order, divide your entries into layers:

- Use a limit order near support

- Place a stop order just above a breakout

- Have a market order ready if price rapidly accelerates

This strategy increases flexibility and adaptability.

Combining Stop-Loss with Strategic Entries

Never enter a trade without knowing your exit. Combine a stop-loss with limit entries, and consider trailing stops to lock in profits on winning trades. The order type you use can either protect your capital or expose you to unnecessary risk.

FAQs on Order Types in Trading

What is the safest order type for beginners?

Limit orders are generally safer for beginners because they provide price control and avoid slippage. Market orders require more precision and timing.

Are stop orders guaranteed to trigger?

No. In fast markets, a stop order may trigger but be filled at a worse price than expected (slippage). A stop-limit order can avoid this but risks not being filled at all.

Can limit orders be partially filled?

Yes. If only part of your order can be matched at your set price, you’ll receive a partial fill, and the rest will stay pending unless canceled.

Why does my market order get executed at a worse price?

Because it takes the best available price — and in volatile or illiquid markets, that price may be far from your intended target.

What’s the difference between stop loss and stop order?

A stop order initiates a market order when a price is hit. A stop loss is a specific use of a stop order to limit losses. Stop loss = strategy; stop order = tool.

Do pro traders use market orders at all?

Yes, especially during breakouts or when they need quick execution. However, they manage size and slippage risk carefully.

Conclusion: Mastering Execution Through Order Types

Execution is where your strategy meets the real market. Understanding and mastering order types in trading is critical whether you’re scalping in and out within seconds or building a long-term swing position.

The most successful traders don’t rely on luck or hope. They combine order flow awareness with precise use of market, limit, and stop orders to enter the market with confidence and exit with profit.

By learning how to properly use these tools, analyzing your trading mistakes, and understanding your platform’s execution mechanisms, you’ll transform from a reactive trader to a strategic operator.